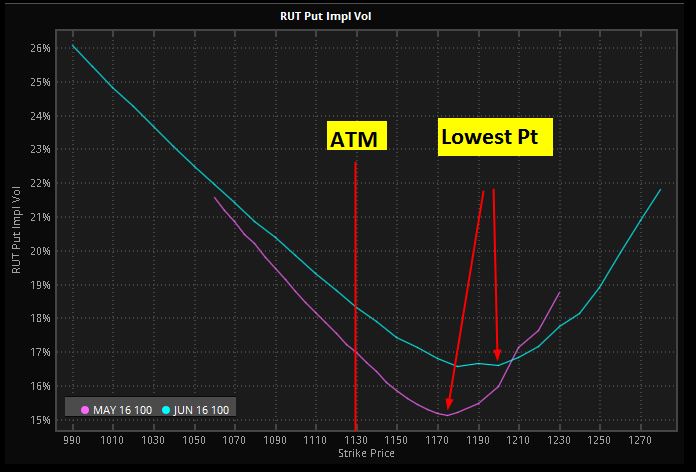

2. How does IV skew affect butterflies? IV skew affects both prices and greeks but the delta is specifically important in trading M3. Firstly we must understand two aspects of the IV skew – (a) the slope and (a) the shape. Look at the IV curve – the left is roughly linear and then about 40 to 50 pts above at the money (ATM), it starts to curve upwards.

The slope of the linear part typically is steeper when : (a) IV is lower, (b) DTE is smaller.

The lowest point on the curve gets closer to ATM as DTE becomes smaller.

As the market moves up, IV skew becomes steeper, strikes above the market will suffer a bigger IV crush than strikes below the market. Therefore, knowing where the right leg of the butterfly is on the IV curve is important.

Typically after a market sell-off, IV skew will be relatively flatter. For instance, after a sell-off, if RUT is about 10 to 20 pts below short strike of the butterfly, then the right leg will likely be at the point where IV crush will be very severe when the market rebound. In this case, the T+0 line will be inaccurate. It’ll give us a false sense of safety on the upside. That means even if you see a flat T+0 line to the upside, it’s fake. Once the IV crush on the right leg, the T+0 line will sink all of a sudden. That’s because when IV crush, delta becomes much more negative and the P&L suffers more than expected. To mitigate this effect, we need to hedge the upside much more aggressively or pull back the right leg closer, ie turning a regular butterfly to a BWB, or alternatively hedge with more positive that what the software shows.

So we must not think that the lowering of IV is always good for butterfly. That is only true if the IVs of all the legs go down simultaneously. In the real world, that will never happen. As a result, we must not take at face value any of the greeks we see on an analyzer, although OV will be much closer to the truth than TOS or ONE. Instead, we must be aware of where the legs of the butterfly are on the IV curve, understand how individual leg IV will behave and then mentally compensate the greeks.

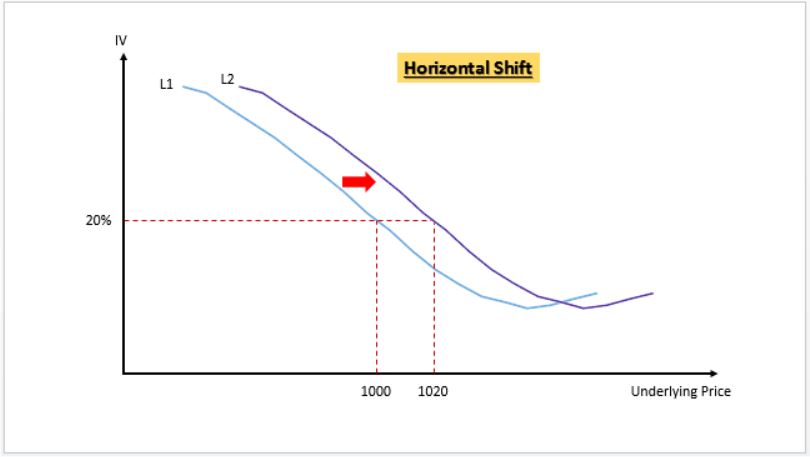

3. Why is the analysis software inaccurate? The main reason is they don’t model the changes in IV accurately. There are three dynamics that need to be taken into consideration : (1) horizontal shift, (2) vertical shift and (3) slope shift. Let me use an example to illustrate. When the market moves up, firstly the entire IV curve is shifted horizontally. Example – if current RUT Is 1000, ATM IV is 20%. RUT moves to 1020. The IV curve will first shift horizontally such that IV @ 1020 is 20%. After this shift the original strike of 1000 actually shows an increase in IV ! See below L1 to L2.

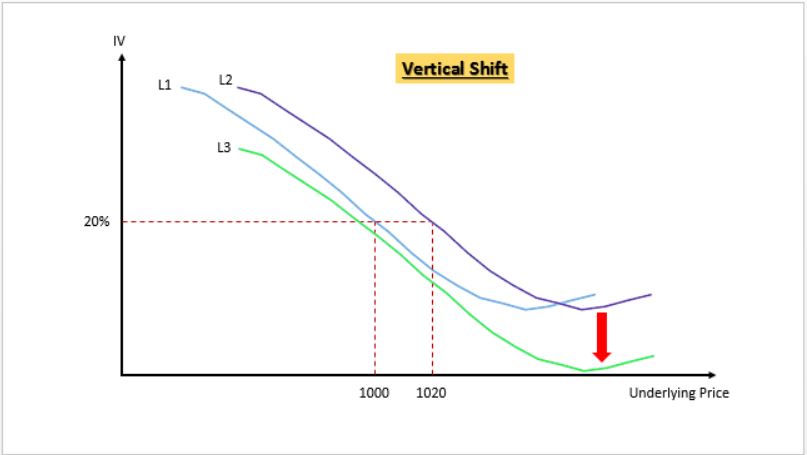

Then step two – vertical shift down. We know that IV goes down as market moves up. The example below – from L2 to L3. So this effect lowers the IV for every strike, countering the increase in IV in step 1. Depends on which effect is bigger, individual IV might end up lower or higher.

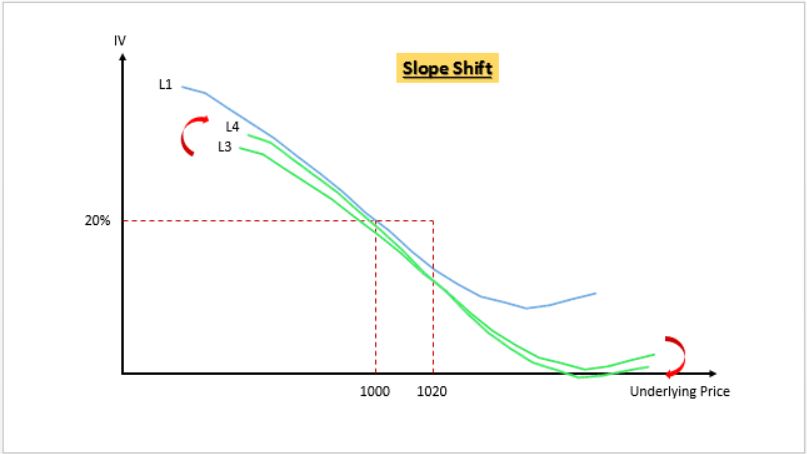

Then step 3 – shift in IV skew. In the case of a reduction of over IV, the IV curve steepens. The example below from L3 to L4. After this clockwise shift in IV curve, some of the lower strike IVs might end up higher than original (ie L4 vs L1).

To accurately model option pricing, software needs to model all 3 shifts. OV takes into consideration step 1 and step 2 via its CEV. But it does not take into consideration step 3, ie the steepening or flattening of IV skew. Think or Swim (TOS) and OptionNet Explorer (ONE) are worse. They do not incorporate any of the shifts. They assume a static IV curve.

To forecast future IV accurately is not a trivial task. The horizontal, vertical and slope shifts are different for each underlying and these shifts also depend on other factors such as absolute IV level, DTE, and market outlook. To model this accurately, the software must start with an accurate regression analysis of the past data – at a minimum incorporating underlying, DTE and IV level. Therefore, my opinion is that the CEV setting must never be a manually inputted number like in ONE.

4. Why did OV’s modeling create a problem few months ago? It started with OV trying to do a better curve fit. The old projected IV model was based on linear regression. It did not take into consideration of the non-linear part of the IV skew (ie the curving up part). The new model tried to achieve a better curve fit by incorporating the non-linear part. The irony is OV actually succeeded in a closer curve fit, but because OV doesn’t take into consideration of the IV slope change, the net result is the upper strikes IV became way over projected and the overall IV curve became too flat. That created all the problems in T+0 and deltas that we all experienced. Now, they reverted back to a “worse” curve fit but nevertheless a more accurate T+n lines.

What OV needs is an accurate modeling of the shift in IV slope. If that can be achieved, then the better regression model will work. But I know this is really difficult. I hope OV succeeds so we can all benefit.

No comments:

Post a Comment